More About Insurance Agent Job Description

Wiki Article

What Does Insurance Asia Awards Do?

Table of ContentsInsurance Code Things To Know Before You BuyNot known Details About Insurance Commission Examine This Report on Insurance CommissionThe Greatest Guide To Insurance AdvisorThe Buzz on Insurance Agent Job Description

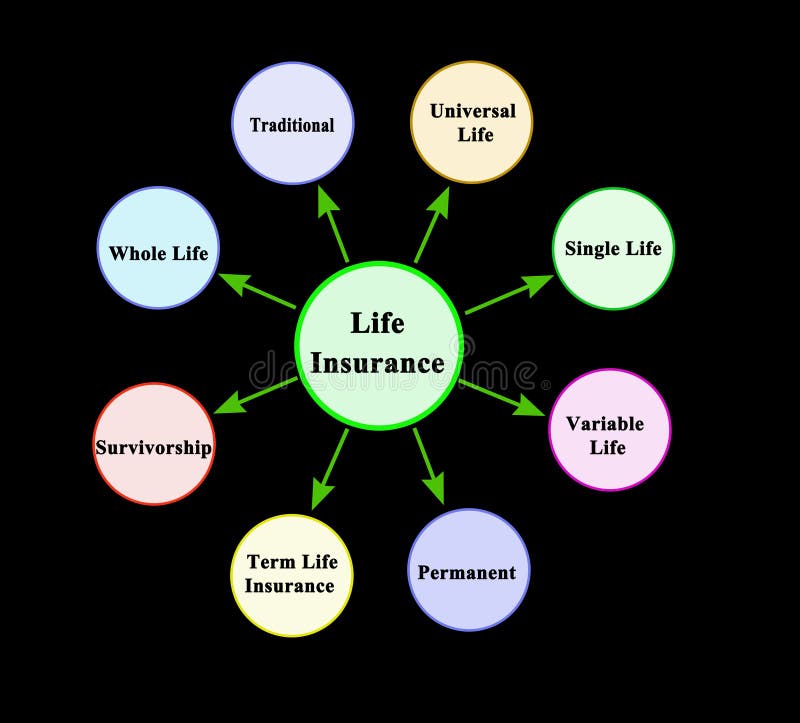

Other sorts of life insurance policyTeam life insurance policy is usually provided by companies as part of the firm's office advantages. Premiums are based on the team as a whole, as opposed to each individual. As a whole, companies offer standard coverage absolutely free, with the option to acquire extra life insurance policy if you require a lot more coverage.Mortgage life insurance policy covers the current equilibrium of your home mortgage and pays to the lender, not your family, if you pass away. Second-to-die: Pays after both policyholders die. These policies can be made use of to cover estate taxes or the treatment of a reliant after both insurance policy holders pass away. Often asked questions, What's the most effective sort of life insurance policy to get? The most effective life insurance policy for you comes down to your needs as well as budget plan. Which types of life insurance policy deal flexible costs? With term life

insurance and entire life insurance policy, premiums generally are taken care of, which implies you'll pay the very same quantity on a monthly basis. The insurance policy you require at every age varies. Tim Macpherson/Getty Images You need to buy insurance coverage to shield on your own, your family, and also your riches. Insurance could save you hundreds of dollars in the occasion of an accident, illness, or disaster. Health and wellness insurance and also auto insurance are called for, while life insurance policy, homeowners, occupants, and handicap insurance are urged. Begin free of charge Insurance coverage isn't the most awesome to think of, yet it's necessaryfor securing yourself, your family members, and your wide range. Crashes, illness, as well as disasters occur constantly. At worst, events like these can dive you right into deep monetary destroy if you do not have insurance coverage to draw on. Plus, as your life adjustments(state, you obtain a new job or have a baby)so ought to your protection.

Some Ideas on Insurance Commission You Should Know

Listed below, we've clarified briefly which insurance coverage you should highly think about purchasing at every stage of life. Note that while the plans below are arranged by age, naturally they aren't good to go in rock. Several people most likely have short-term impairment with their company, long-term impairment insurance policy is the onethat the majority of people need as well as do not have. When you are damaged or sick and also unable to function, impairment insurance policy provides you with a percent of your wage. As soon as you exit the functioning globe around age 65, which is often completion of the lengthiest policy you can get. The longer you wait to get a policy, the better the eventual expense.If somebody else counts on your income for their financial health, then you possibly require life insurance. The ideal life insurance plan for you depends on your budget plan as well as your economic goals. Insurance you require in your 30s , Home owners image source insurance coverage, Home owners insurance coverage is not required by state legislation.

9 Easy Facts About Insurance And Investment Shown

-If, nevertheless, you endure the term, no cash will be paid to you or your family members. -Your household receives a certain sum of money after your death.-They will certainly likewise be entitled to an incentive that usually accrues on such quantity. Endowment Policy -Like a term plan, it is also legitimate for a specific duration.- A lump-sum quantity will certainly be paid to your family in case of your death. Money-back Plan- A specific percentage of the amount assured will certainly be paid to you periodically throughout the term as survival benefit.-After have a peek at these guys the expiration of the term, you obtain the balance quantity as maturation proceeds. -Your family gets the entire sum ensured in situation of death throughout the plan period. The quantity you pay as premium can be subtracted from your complete taxable revenue. Nevertheless, this undergoes an optimum of Rs 1. 5 lakh, under Section 80C of the Earnings Tax Obligation Act. The costs amount made use of for tax reduction should not exceed 10 %of the sum ensured.What is try this General Insurance policy? A general insurance is a contract that supplies economic payment on any loss other than death.

Getting The Insurance Ads To Work

Your health insurance policy took treatment of your therapy costs. As you can see, General Insurance coverage can be the response to life's various issues. Pre-existing diseases cover: Your health and wellness insurance takes treatment of the therapy of illness you may have prior to purchasing the wellness insurance coverage policy.Two-wheeler Insurance coverage, This is your bike's guardian angel. As with car insurance, what the insurer will pay depends on the kind of insurance coverage and what it covers. Third Celebration Insurance Coverage Comprehensive Cars And Truck Insurance Policy, Makes up for the damages caused created another one more, their vehicle automobile a third-party property.

Report this wiki page